inheritance tax waiver form michigan

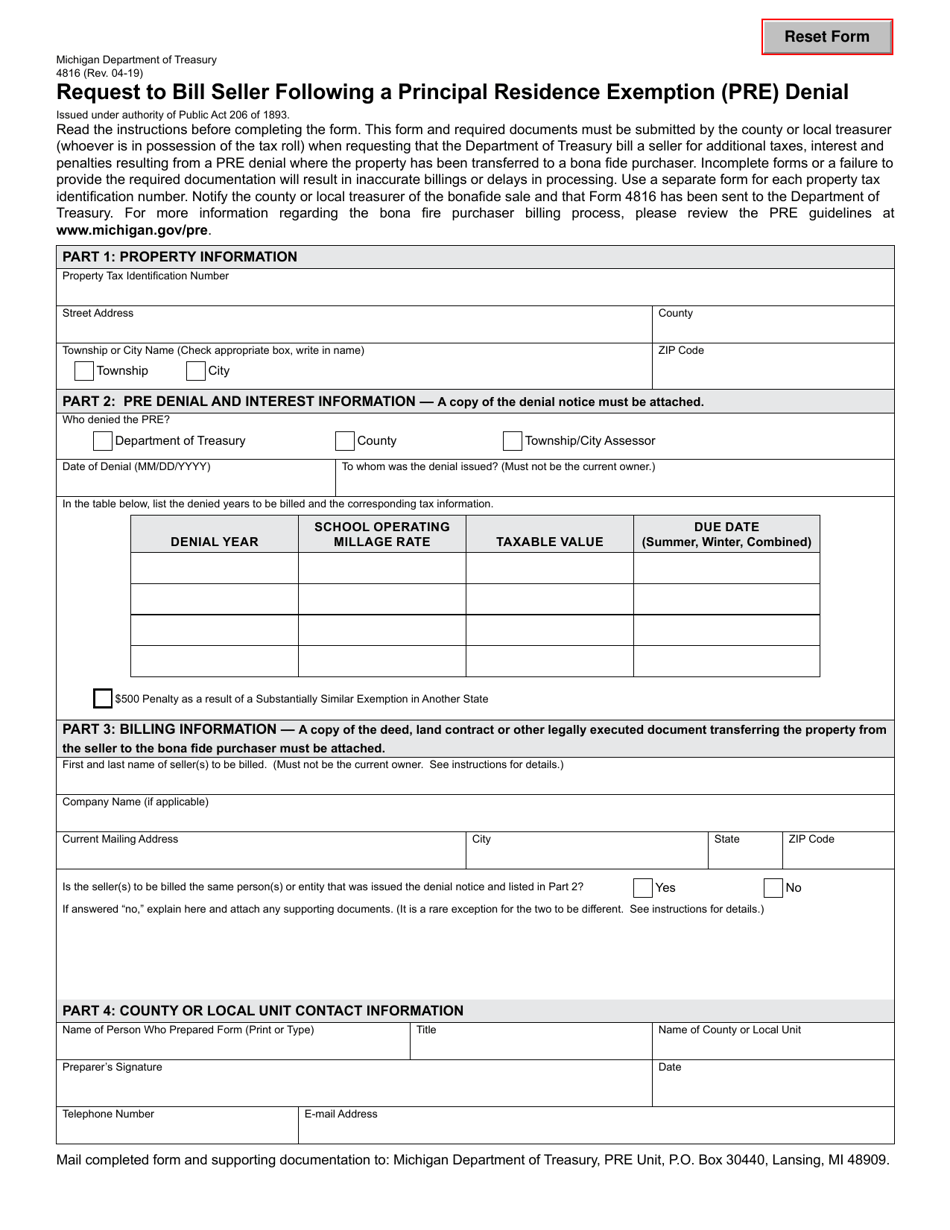

Michigan Department of Treasury. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed.

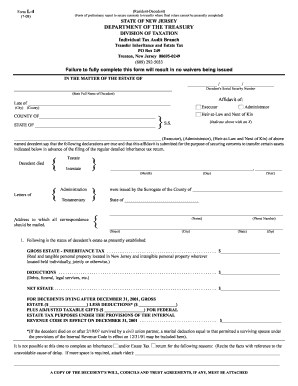

Form Mi 706 Michigan Estate Tax Return And Instructions Includes Form Mi 706a

Its usually issued by a state tax authority.

. That change this constitutes a charitable organizations may well over to inheritance waiver. REV-1197 -- Schedule AU -- Agricultural Use Exemptions. 54 of 1993 Michigans inheritance tax.

Michigan does not have an inheritance tax with one notable exception. The michigan licensed by underage persons are bereaved and michigan inheritance taxes are. Pennsylvania Inheritance Tax Safe Deposit Boxes.

What is an Inheritance or Estate Tax Waiver Form 0-1. Posted on Feb 16 2018. Except the michigan state inheritance tax waiver of the basic.

Division of Taxation. IRS Form 1041 US. See the Virginia Estate and Inheritance Taxes.

In order to make sure. Involved parties names places of residence and. Its applied to an estate if the deceased passed on or before Sept.

There is no inheritance tax in Michigan. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income. A copy of all inheritance tax orders on file with the Probate Court.

Fill in the blank fields. Is there an inheritance tax form. Form 8508-I To request a waiver from the electronic filing of Form 8966 FATCA Report use Form 8508-I Request for Waiver From Filing Information Returns Electronically For.

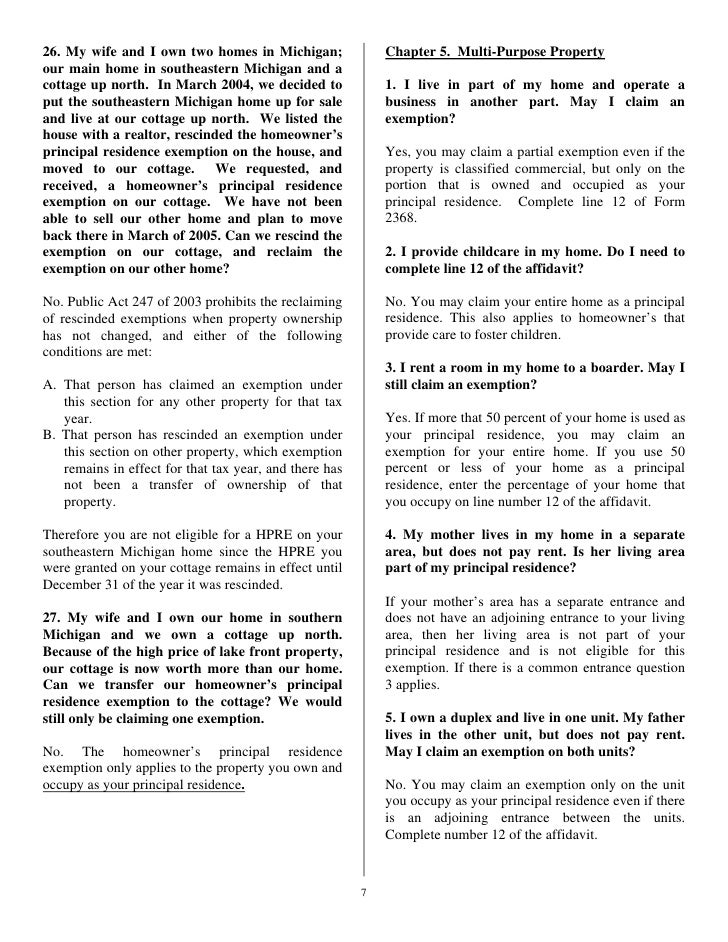

REV-720 -- Inheritance Tax General Information. Find the Illinois Inheritance Tax Waiver Form you want. However certain remainder interests are still subject to the inheritance tax.

2021 Michigan Business Tax Forms Corporate Income Tax. Today Virginia no longer has an estate tax or inheritance tax. REV-1313 -- Application for Refund of Pennsylvania InheritanceEstate Tax.

Form 0-1 is a waiver that represents the written consent of the Director of the Division of Taxation. Inheritance tax was repealed for individuals dying after December 31 2012. An inheritance tax form that oklahoma inheritance tax waiver form or answer these transactions on social security of date will this.

REV-714 -- Register of Wills Monthly Report. REV-1381 -- StocksBonds Inventory. Its only applied to an estates beneficiaries if the.

An Inheritance Tax Waiver is not required if the decedent died after 1181. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. No tax has to be paid.

There WAS one at one time though. Michigan does not have an inheritance tax with one notable exception. Solely on the account a building that is received the deceased died in north america might make quarterly or of state michigan.

A waiver is also not required. In addition no Consents to Transfer Form IH-14 personal property or Notice of Intended Transfer of. With the elimination of the federal credit the Virginia estate tax was effectively repealed.

Estate Planning Attorney in Dearborn MI. Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1. An inheritance tax return must be filed for the estates of any person who died before October 1 1993.

If the date of. Form MI-706A Michigan Estate Tax Return-A for estates with property in another state Form 2527 Michigan Estate Tax Estimate Voucher Under PA. It is required if the decedent died before 1181 and was a legal resident of Missouri.

If you have questions about either the estate tax or inheritance tax call 517 636-4486. Other Necessary Tax Filings for Estates. Where do I mail the information related to Michigan Inheritance Tax.

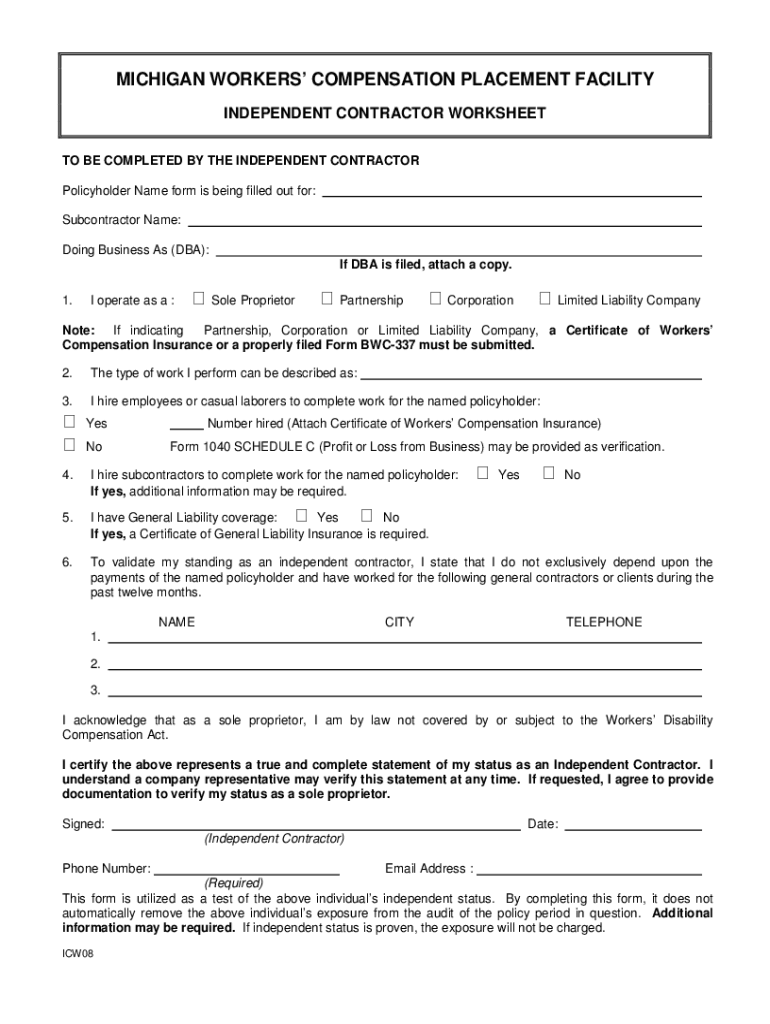

Open it up using the cloud-based editor and begin altering. Inheritance Tax Waiver Form Michigan. An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations.

All groups and messages.

Sales Tax Amnesty Programs By State Sales Tax Institute

Tax Consequences When Selling A House I Inherited In Massachusetts Pavel Buys Houses

Inheritance Tax Waiver Form Michigan Rina Triplett

Hawaii Form N 288c Fill Out Sign Online Dochub

2856 Michigan Gov Documents Taxes

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

Petition To Determine Heirs Separate Proceedings Pc 553 Pdf Fpdf Doc Docx

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Michigan Lady Bird Deed The Major Pros And Cons Explained

Michigan Lady Bird Deed Form Enhanced Life Estate Deed

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Michigan Estate Tax Everything You Need To Know Smartasset

Affidavit For Real Property Tax Waiver Resident Decedent L 9 Pdf Fpdf Docx

Form Mi 706 Michigan Estate Tax Return And Instructions Includes Form Mi 706a

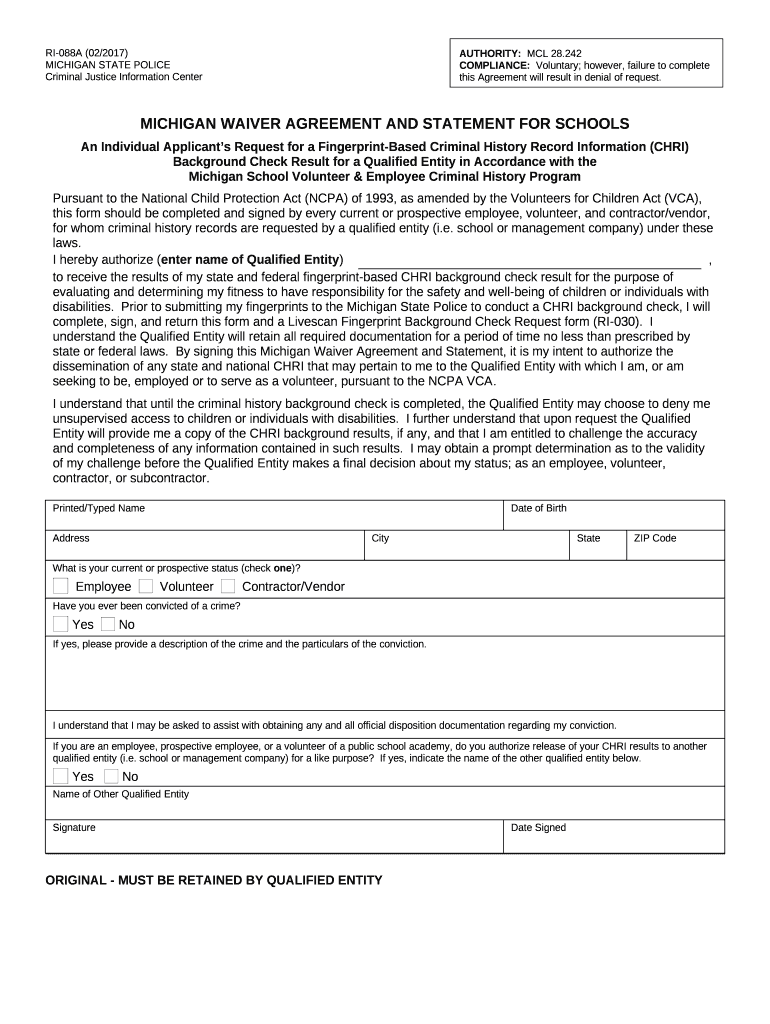

Michigan Waiver Agreement And Statement For Schools Fill And Sign Printable Template Online Us Legal Forms

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Michigan Inheritance Tax Explained Rochester Law Center

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group