tax avoidance vs tax evasion examples

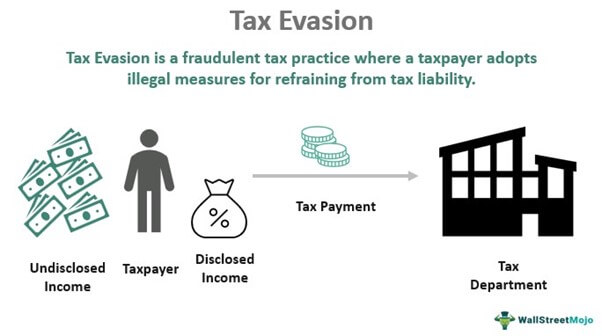

Tax evasionThe failure to pay or a deliberate underpayment of taxes. The other one is the evasion of payment.

Your Convenience Is A Priority Smarttaxservices Taxes Tax Services Priorities Smart

Tax Exemption is a grant of immunity express or implied to.

. 1 Ignoring overseas income. Tax avoidanceAn action taken to lessen tax liability and maximize after-tax income. Keeping a tip log B.

Tax Evasion vs Tax Avoidance. Tax avoidance means using the legal means available to you to reduce your tax burden. This could include travel.

This includes not paying taxes you owe even though your income is reported. Or both and be responsible for prosecution costs. Distinction between Tax Evasion and Avoidance Tax Evasion vs Tax Avoidance accomplished by breaking the letter of the law accomplished by legal procedures or means which maybe contrary to the intent of the sponsors of the tax law but nevertheless do not violate the letter of the law VI.

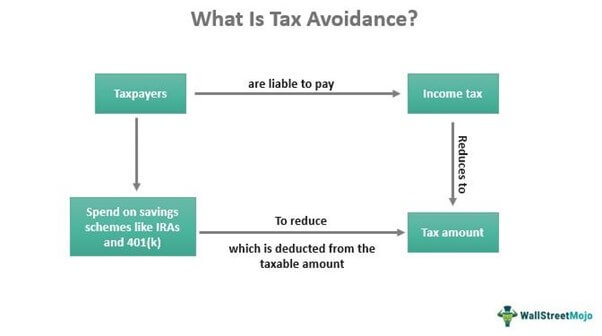

When you avoid tax payment via illegal means it is called tax evasion. You might do this by claiming tax credits for example or investing in tax-advantaged Individual Retirement Accounts IRAs or 401k plans. If you or a loved one has been accused of tax evasion.

Tax Avoidance vs Tax Evasion. Like it presently stands avoiding the tax is totally legal but when someone crosses this line in tax-evading then it will result in huge fines and even prosecution. Some may only pay a part of their taxes and leave out the rest.

Having tax software opens in new tab can help you manage stuff like this legally. Here are some examples of tax evasion. As discussed tax avoidance is the.

Not reporting interest earned on loans C. Tax avoidance tax evasion both of them are different things having different meanings and consequences. Also it does not take much time.

Youve seen the examples of tax evasion and tax avoidance above. Fined up to 100000 or 500000 for a corporation. Definition and Examples.

Examples of Tax Avoidance. Ignoring earnings for pet-sitting D. The IRS will deduct expenses for non-reimbursed business expenses.

There are a number of penalties that authorities could apply such as a failure to file penalty or an underpayment penalty. Mailing tax forms on time C. Take advantage of each deduction.

Often taxpayers can overlook their cryptocurrency holdings that have increased in value. Tax Evasion vs. Some examples of legitimate tax avoidance include putting your money into an Individual Savings Account ISA to avoid paying income tax on the interest earned by your cash savings investing money into a pension scheme or claiming capital allowances on things used for business purposes.

Tax Avoidance Examples of tax avoidance strategies Tax deductions and credits. According to the IRS tax avoidance is an action you can take to reduce your tax liability and therefore increase your after-tax income. For instance the transfer of assets to prevent Uncle Sam from estimating their actual tax liability is an attempt to evade review.

2 Banking on Bitcoin. Federal income tax than necessary because they misunderstand tax laws and fail to keep good records. This often affects people with rental properties overseas.

Tax Evasion vs Tax Avoidance vs Tax Planning. Tax avoidance is perfectly legal and encouraged by the IRS but tax evasion is against the law. The major difference between tax avoidance tax evasion is its legality.

Is tax avoidance legal or illegal. The following paragraphs detail what you should know about each concept. This is one of the most common tax evasion examples.

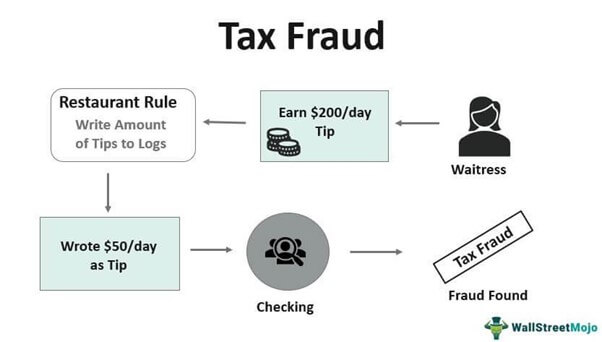

Conversely tax evasion is the failure to pay or the intentional underpayment of your taxes. Keeping accurate and organized records E. She earns on average an amount of 200 every night through tips.

As we know tax evasion is an illegal and unethical practice of an individual or firm to escape from paying fair taxes to the government. Classify the tactics below as examples of Tax Avoidance or Tax Evasion by clicking on the correct answer. Activity 1 Circle each example of tax evasion.

What is tax evasion. Examples of tax evasion. Hazel is the server at a very popular Chophouse.

This occurs either when the taxpayer does not pay tax or bypasses assessment. When it comes to taxes and the IRS sometimes there is a fine-line between planning to minimize taxes aka legal Tax Avoidance and committing criminal tax fraud especially in the realm of international and offshore tax aka Tax Evasion. Tax Evasion Examples Hypothetical Example.

To assess your answers click the Check My Answers button at the bottom of the page. Trust the Attorneys at the Law Offices of Kretzer and Volberding PC. Ignoring earnings for pet-sitting.

If income is not reported by someone authorities do not possess a tax claim on them. Deductions are a great way to reduce your taxable income. Imprisoned for up to five years.

Exemption from Taxation A. Tax evasion on the other hand is when illegal tactics are used to avoid paying taxes such as hiding or misrepresenting income or. A taxpayer charged with tax evasion could be convicted of a felony and be.

1 Keeping a log of business expenses. Are you unsure of the difference between tax avoidance vs. Tax evasion on the other hand is using illegal means to.

The IRS has rules about cryptocurrencies and their transactions are taxable. Person determines whether the tax planning activities they are.

Tax Fraud Definition Types Examples Punishment

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Tax Evasion Tax Avoidance Definition Comparison For Kids

Explainer What S The Difference Between Tax Avoidance And Evasion

Tax Evasion Vs Tax Avoidance What Are The Legal Risks

Tax Treaty Shopping And The General Anti Avoidance Rule

Tax Avoidance Vs Tax Evasion Expat Us Tax

Tax Avoidance Vs Tax Evasion Infographic Fincor

Tax Planning Tax Avoidance Tax Evasion Tax Planning Management Taxation Laws Income Tax Youtube

Tax Evasion Vs Tax Avoidance Vs Tax Planning A Detailed Comparison With Examples Urdu Hindi Youtube

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Planning Tax Evasion Tax Avoidance And Tax Management Avs Associates

Which U S Companies Have The Most Tax Havens Infographic

Differences Between Tax Evasion Tax Avoidance And Tax Planning